Shares of Enphase Energy Inc. (NASDAQ: ENPH), a leading U.S.-based solar technology company, have faced considerable headwinds, sparking analysis over whether the stock is now undervalued. The company's share price has fallen more than 57% so far this year, reaching a 52-week low of $37.73 on May 22, 2025—a 59.75% decline over the past twelve months, according to Investing.com.

Current trading data shows Enphase Energy shares at $30.22, down $0.98 (-0.03%) since the previous session as of Monday, November 10, 01:33:14 PST. This downturn has exceeded the volatility experienced in broader markets and prompted many investors to reassess their portfolios, particularly regarding stocks perceived as high growth with significant insider ownership or those trading below analyst price targets.

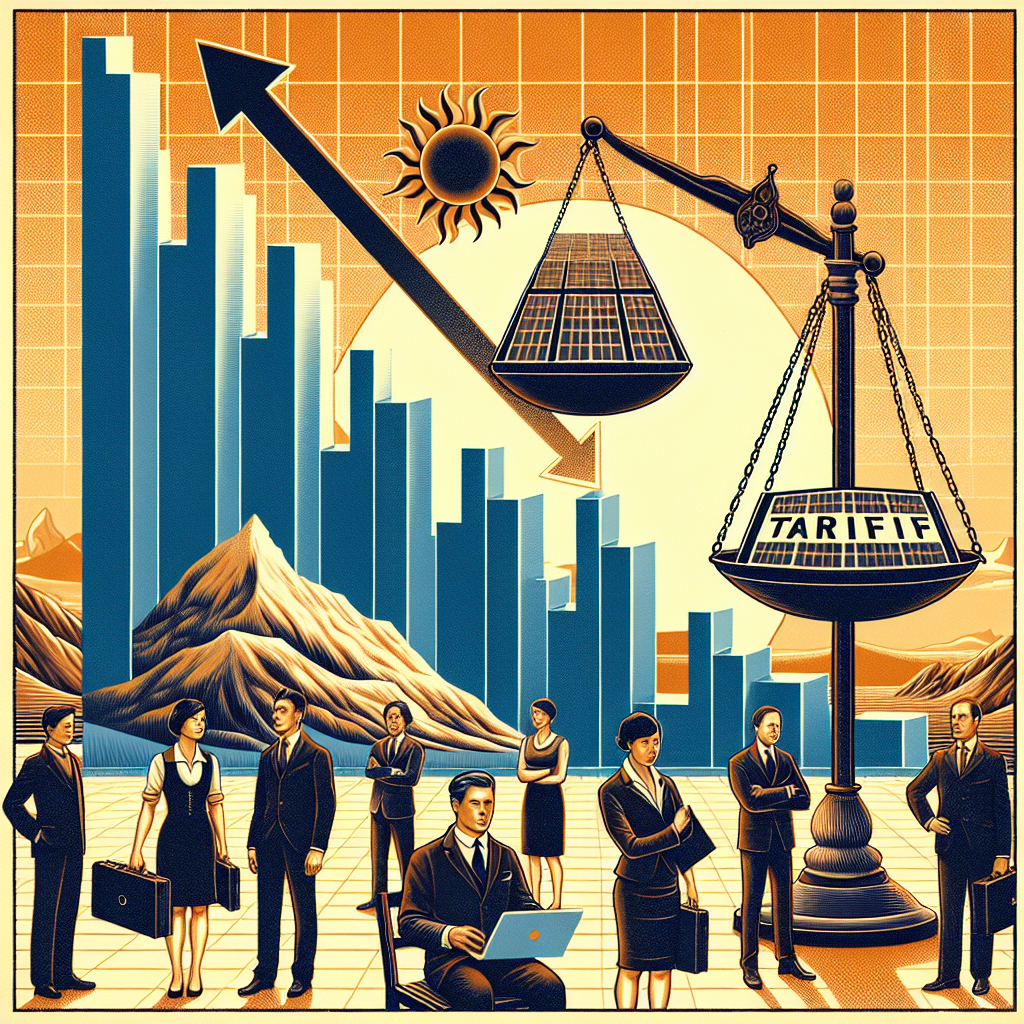

The steep stock decline followed a reported 42% drop in revenue, from $2.29 billion in 2023 to $1.33 billion in 2024, as detailed by Trefis.com. The contraction is primarily attributed to a collapse in residential solar demand, fueled by high interest rates that have made solar installations more expensive and less accessible for homeowners.

Adding to these difficulties are trade policy concerns. Enphase contends with tariffs over 40% on Chinese solar cell packs—the type pivotal to its products—which has put direct pressure on profitability, as reported by Reuters. Recent analyst reactions include a downgrade from Goldman Sachs, which shifted its rating from Buy to Sell and reduced its target price to $32, citing regulatory uncertainties and the impact of these tariffs (Finviz.com).

Despite the turmoil, some market observers see upside potential. Supporters of Enphase's long-term story highlight compelling tailwinds such as global electrification trends, higher utility rates, ongoing grid upgrades, and the growing adoption of electric vehicles—all of which underpin continued demand for Enphase’s integrated solar and storage solutions. The company’s expansion into new products, including electric vehicle charging, is seen as a catalyst for both future growth and recurring revenue.

Examining valuation metrics, Enphase Energy currently trades below the industry and peer averages, but just above the sector’s historical low. This positioning could represent a discount opportunity if investor sentiment recovers. Still, skepticism remains as the optimistic outlook depends on aggressive assumptions about solar adoption rates and Enphase’s ability to restore profitability, all while managing operational risks like inventory oversupply and uncertain market demand.

Analysts emphasize the importance of balancing optimism about Enphase’s role in the renewable sector with caution given ongoing challenges. According to Investing.com, some experts still regard Enphase as fundamentally strong and strategically well-placed within the clean energy transition, even as its shares trade at levels deemed potentially undervalued.

A more detailed examination can be found in the original analysis at Yahoo Finance.

As the market continues to reprice solar-related equities in response to policy adjustments, interest rates, and global economic shifts, Enphase Energy’s next steps will be closely watched. Investors are urged to conduct thorough research and weigh both rewards and risks before making portfolio decisions, noting that this overview is provided for general informational purposes and does not constitute financial advice.