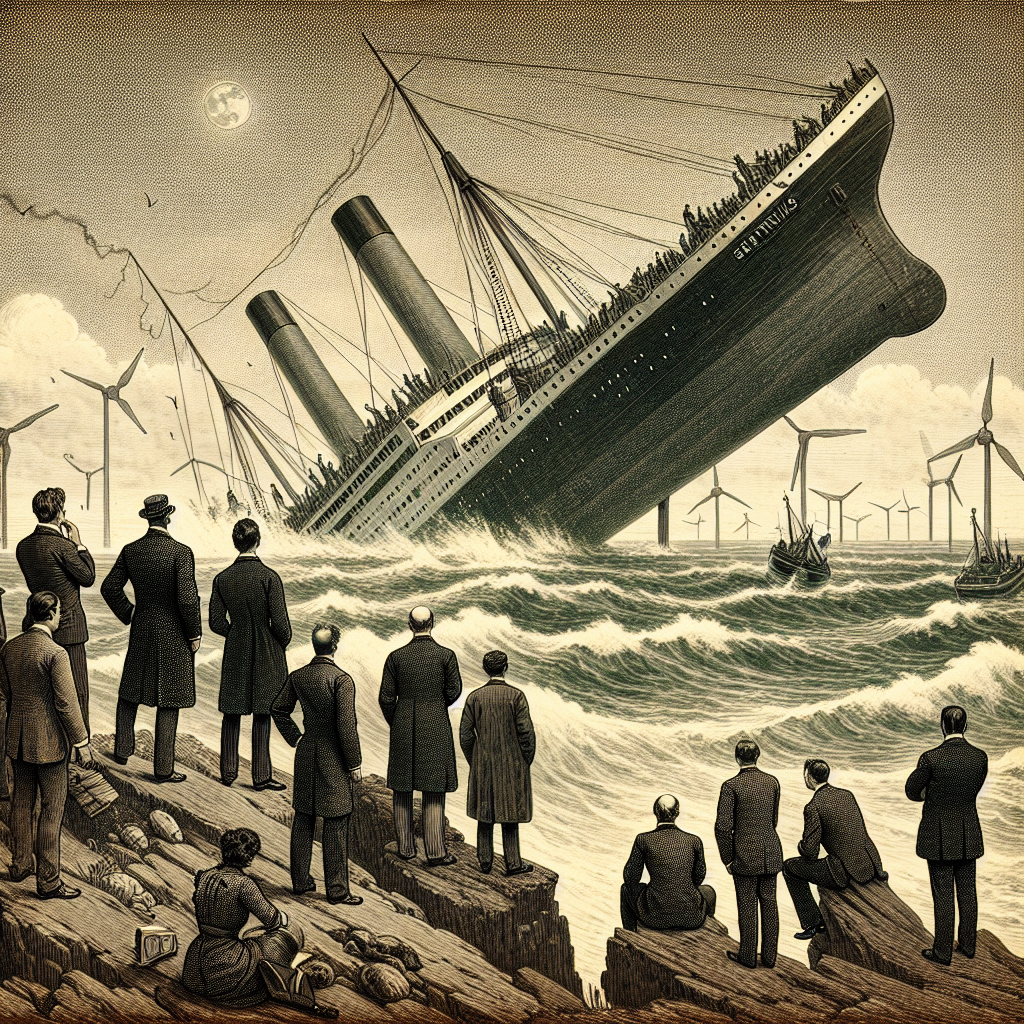

Shares of Seatrium Limited (SGX:5E2), a Singapore-based company formerly known for its shipbuilding operations, have continued to experience downward pressure, falling by 3.3% this week. The ongoing decline extends a troubling trend for the company’s shareholders: over the last five years, Seatrium’s share price has plunged by approximately 74% (Yahoo Finance).

This marked drop in share value stands in stark contrast to the company’s reported financial growth over the same period. From 2020 to 2024, Seatrium achieved an average annual revenue increase of 27%, reaching S$9.23 billion in 2024 (ainvest.com). The company’s renewed profitability and ongoing transformation, however, have yet to substantially improve shareholder returns.

Despite the robust increase in revenue, Seatrium’s net profit margin remains modest at 1.7% for 2024, highlighting persistent difficulties in converting top-line growth into meaningful profits. The company has also undergone significant strategic changes. In 2023, Seatrium pivoted from its core shipbuilding business to focus on renewable energy, including offshore wind farms and green hydrogen infrastructure. This shift contributed to a dramatic 274% revenue surge in 2023 and marked a return to profitability. The company also reported a record high order book of S$23.2 billion by the end of 2024, up 43% from the previous year, underpinned by S$15.2 billion in new contracts (TipRanks).

While these figures suggest a potential turnaround story, analysts caution that challenges remain. Notably, Seatrium’s debt-to-equity ratio stands at 0.49, indicating moderate leverage, but the interest coverage ratio is low at 0.56, reflecting limited ability to meet debt obligations should market conditions worsen (ainvest.com). The company’s return on equity (ROE) is also modest, at 2.44%, suggesting issues with efficient capital deployment (Simply Wall St).

Investors are advised to consider not only the share price trajectory but also the total shareholder return (TSR), which includes dividends and other capital distribution measures. Over the past five years, TSR for Seatrium has outperformed the share price return, suggesting dividend payments have cushioned some losses. In the most recent year, the TSR was -6.0%, an improvement over the average annual loss observed in the previous five-year span.

Market experts are divided on Seatrium’s outlook. Some point to the company’s low price-to-sales ratio of 0.23x—considerably below that of peers such as Yangzijiang Shipbuilding (0.6x)—as a signal that existing risks may already be factored into the share price (ainvest.com). Others warn that persistent low margins, high debt, and limited debt-servicing capabilities could continue to weigh on the company.

In summary, Seatrium’s efforts to diversify into renewable energy and grow its business have delivered notable revenue gains, but significant concerns remain regarding profitability, leverage, and overall capital efficiency. Analysts stress that all assessments are based on historical figures and forecasts, cautioning that they should not be interpreted as financial advice. Prospective investors are encouraged to undertake their own research and analysis, considering both company fundamentals and broader sector valuations before making investment decisions.